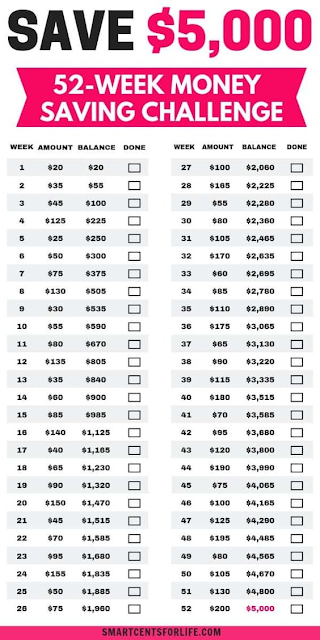

Simple 52-Week Money Saving Challenge: $5,000 Savings in One Year

Do you need some encouragement to make some savings? Try out this 52-week savings challenge to see out how much money you can save in a year, $5,000!

With an additional $5,000 in savings, you can accomplish a lot of things.

This sum of money can be used for a variety of things, such as:

- Paying off debt

- Buying a new car

- Setting it aside for a house down-payment

- Taking a vacation

- Increasing your emergency fund

- Saving for college

To be honest, there are countless things you can do with $5,000 in savings.

The question is, how can you raise some more cash to support any financial objectives you may have?

In order to help you save that $5,000, this is where the 52-week money-saving challenge comes into action.

Only a plan and dedication will help you succeed with this money-saving challenge.

XEM THÊM :

Chơi Game Đánh Bài Tiến Lên Ở Đâu Uy Tín – CORONA888

How Does the 52-Week Money Saving Challenge Work?

- To receive the printable 52-week money-saving challenge, fill out the form below. (You'll have access to our newsletter as well!)

- The two 52-week money challenge printouts can be downloaded and printed.

- Each week, make the recommended deposit and mark the "Done?" column's checkbox.

*Note: For this money-saving challenge, I advise opening a savings account and, if you can, automating your weekly savings. Any bank may easily complete this. Your task of saving money will be made easier by this tip.

52-Week Money Saving Challenge Printable

You may complete this 52-week money-saving challenge, and I'll give you some tips on how to try to save the $5000 you want to in a year.

Some important things to consider:

- Try to stick to the amount listed on the printable 52-week money saving challenge, but if you find yourself short on funds one week, you may always pick a week when you can afford it and record that week's challenge as complete.

- Try not to make this a habit and instead be consistent with your savings. If you are able to afford more each week than you anticipated, save it! Always go for more!

I am aware that it is sometimes harder than it seems to save money. But if you put in a little work, you can create a plan to lower your costs and save money each month.

To assist you with your 52-week money-saving challenge, I have put together a list of money-saving suggestions you can use.

1. Create a Budget

If you have never created a budget before, this advice may seem daunting at first.

However, creating a budget will enable you to track your spending each month. Additionally, it might be quite beneficial for money management.

You can save money by cutting back on some areas with the use of a budget.

You should read How to Budget for Beginners if you need assistance creating your first budget or are unsure of where to begin. It will provide you all the information you need to make your first budget.

2. Reduce your Grocery Budget

We have to incur the cost of buying food. No matter how much or how little money you have set aside for groceries, there are several things you can do to lower your monthly shopping price.

- Weekly meal planning is an excellent way to reduce your grocery bill. Aim for a straightforward, doable meal plan. There are services like the $5 Meal Plan, which lets you construct a weekly meal plan for your entire family, and it only costs $5 a month, if you need more suggestions for meal planning on a tight budget. For all the ideas you receive, it's quite affordable!

- Make a list for your grocery shopping since, in my experience, if I don't have one, I'm more likely to overpay on items that I won't use right away. I prefer making a shopping list and following it every time I visit the grocery store to prevent this.

- Shopping at home is sifting through your pantry to determine what you need and don't need, then creating a list based on that. This matches to your shopping list. You might find that this little tip really reduces the cost of your supermarket shopping.

- Utilize the sales at your local food shop and, if your budget permits, attempt to stock up on discounted items. To further reduce your grocery price, you may also base your meal plans on the things you discover on sale.

- Going Generic: You can lower your shopping price by purchasing select generic items including canned groceries, frozen meat, and beans. Generic brands are typically of a comparable quality to name-brand products. Purchasing generic brands is not inherently wrong. In fact, you might be shocked to learn that certain generic goods actually taste better than name-brand goods despite having fewer ingredients.

3. Use Money Saving Apps

These two apps are a game-changer if you need a little help getting started on this challenge! These two free apps can assist you in making little changes to your shopping habits that will significantly increase your savings!

Ibotta

Every time I go grocery shopping, I utilize this app to reduce my spending. I can simply obtain cash back from my purchases thanks to Ibotta. When purchasing items like milk, potatoes, bananas, bread, and other items that the majority of families typically purchase at the grocery store, you can receive cashback.

I had a few occasions where I could withdraw about $200 in a month. Using this software will undoubtedly increase your savings.

Ibotta is presently offering a $10 incentive for signing up, which is fantastic news. This entails earning free money for your savings challenge!

For all of my online buying, Rakuten is my second favorite app. You can get a discount from Rakuten on every online purchase!

You can get up to 10% cash back from Rakuten on your online purchases. Hundreds of retailers are taking part, including Amazon, Target, and Walmart. The best part is that Rakuten registration is completely free and there are no additional costs.

Simply download the Rakuten app, create a free account, choose the store you want to purchase from, and shop as you normally would. Cash back will be automatically added to your account. After making your first $25 purchase, you'll also receive a free $10 welcome bonus!

You may save a lot of money with the aid of the free program Trim. With Trim's assistance, you may haggle and save up to 30% on your phone, internet, and cable costs. Additionally, it will look to see if you have any unnecessary memberships and cancel them for you so you may save money.

Anyone who is serious about saving money sensibly has to download the money-saving program Trim.

4. Reduce Your Utility Bills at Home

The US Department of Energy estimates that the average American family spends more than $2,000 a year on power costs. Of course, this sum of money can vary based on where you reside, how big your house is, how many resources you use, etc.

The good news is that you can lower your utility bills at home regardless of how much you now pay for utilities. This can be accomplished by making tiny modifications around the house that will have a significant impact on your finances.

Here are some actions you can do to lower your household utility costs:

- Change the thermostat (use the proper setting for winter and summer).

- Unused appliances should be disconnected.

- Put in energy-efficient light bulbs.

- Use cold water to wash your items.

- Reduce the temperature of your water heater.

5. Cut the Cord

We gave up cable a little more than a year ago, and it was one of the best choices we ever made. We currently watch all of the channels for free thanks to this digital antenna, which is a fairly small expenditure.

Our Amazon Fire Stick was also installed, allowing us to view our preferred TV episodes and movies without having to shell out a lot of money.

Now we can still watch our favorite TV shows while saving over $100 a month!

Final Thoughts

By implementing some of the above suggestions, you can most definitely complete this money-saving challenge and save $5,000 in a single year.

Read Article:

Comments

Post a Comment